- Need to Schedule an Appointment?

Author: bshearer82

Want Happy Accounting Clients? These Strategies Will Help You

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Which Financial Statements Have the Biggest Impact on Client Success?

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

How Bookkeeping Fits Into CAS & Why You Should Set it to Autopilot

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

How Your Firm Defines CAS Will Determine Your Growth Strategy

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Crypto Airdrop Taxes

Before 2019, taxation on Airdrop tokens was fairly unclear. There were two sides that most tax professionals were on. One was that airdropped tokens were only taxable when sold, using a cost basis of zero. This followed the logic of stock splits. The other side said that you pay tax as ordinary income on the […]

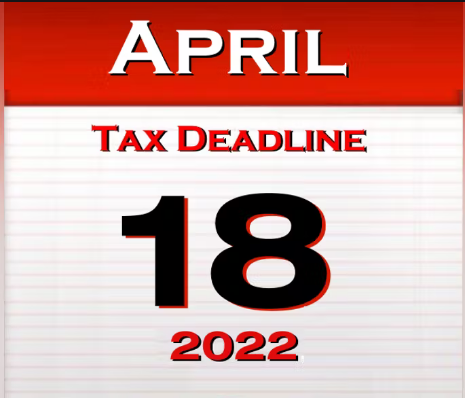

Important 2022 Tax Dates

Important dates for the upcoming tax season! – Efile for the 2021 tax year officially opens up on January 24th – W2s and 1099s are to be mailed by January 31st – S Corp & Partnerships are due March 15th – C Corp and Personal Taxes are due April 18th (due to Emancipation Day on […]

Save Money on Taxes and College with a 529 Plan

Paying for a child’s education is certainly one of the greatest gifts you can give. But the costs of higher education have been rising at a shocking rate. With in-state expenses at a public school averaging just below $20,000 per year, you may be wondering what you can do. One excellent solution to ease the […]

8 Tips to Help Your Small Business Save in Taxes

Personal taxes can be complicated. Business taxes can be even more difficult. If you own a small business, tax time can be challenging. The livelihood of any company is at least partially dependent on its ability to minimize its tax liability, while meeting the requirements of the IRS. While taxes are rarely enjoyable or interesting […]

IRS Standard Mileage Deduction or Actual Expenses? Which One is Better for You?

One of the most common trouble spots that business owner incur is how to treat vehicles for business purpose. Most business owners ask about deducting mileage and then also the payments on the vehicle, and are shocked to learn you can only do one or the other. Also, once you choose one method on that […]

Blockchain Interview

What Did You do before Blockchain? Actually, the same thing as I am doing now, but with a different clientele. Before I got involved in blockchain, I was still an accountant helping business and individuals with their goals and planning. While I still serve the same clientele I did before, I now have a whole […]